By Brett Walton, Circle of Blue

The Great Lakes News Collaborative includes Bridge Michigan, Circle of Blue, Great Lakes Now at Detroit PBS, Michigan Public and who work together to bring audiences news and information about the impact of climate change, pollution, and aging infrastructure on the Great Lakes and drinking water. This independent journalism is supported by the Charles Stewart Mott Foundation. Find all the work HERE.

MILWAUKEE – Mounting concern about chemical contaminants in sewage sludge, a waste product widely seen as recyclable and economically valuable, could turn into a costly liability and upend the finances of municipal wastewater utilities across the county.

The worry is particularly relevant in Milwaukee, Wisconsin’s largest city, which for 99 years has stripped its wastewater of liquid effluent, pathogens, heavy metals, and some chemicals to produce “biosolids” that it converts into a nitrogen-rich fertilizer. Trademarked as Milorganite – short for Milwaukee organic nitrogen – the turf grass fertilizer is bagged for commercial retail sale in home-and-garden centers in 49 states.

All except for Maine. Recent changes in oversight in that Northeast state have rattled the wastewater treatment industry and prompted the Milwaukee Metropolitan Sewerage District to assess the viability of a product that represents a sizable revenue stream, providing 10 percent of the utility’s annual operations and maintenance budget.

In April 2022, Maine became the first state to ban the land application of biosolids. The prohibition, enacted due to safety concerns about a class of toxic chemicals known as PFAS, applies not only to biosolids spread on farm fields, which is the most common disposal option for wastewater facilities. It also extends to retail lawn and golf course fertilizers like Milorganite that are derivatives of the sewage treatment process.

Yesterday, the U.S. Environmental Protection Agency released its first draft assessment of PFAS in biosolids, finding health risks for people living on or near areas where biosolids are land applied or deposited in an unlined landfill. The assessment of PFOA and PFOS, the two most-studied of the chemicals, considered risks for people who regularly consume food and water from those lands, not for the general public.

The leaders of MMSD are keenly aware of how regulatory pressures might affect operations. The year after Maine’s ban new language appeared in the utility’s annual budget document. In a section titled “Strategic Framework,” the utility prioritized a “sustainable bottom line.” Among the six strategies to achieve that goal was to “ensure Milorganite remains a viable product.”

When asked about the origin of that budgetary language, Kevin Shafer, the MMSD executive director, said it came from a biosolids master plan that the utility had just completed in response to regulatory developments nationwide.

“Most of our sustainability – environmental, financial – is built off that foundation of Milorganite being a sustainable product,” Shafer said.

MMSD’s net revenue from Milorganite sales in 2023 was $12.2 million, which accounted for just over 10 percent of the operations and maintenance budget. The utility annually recycles more than 95 percent of its 40,000 to 50,000 tons of biosolids in the form of Milorganite. If that option were removed due to regulation or a change in public sentiment, Shafer reckoned that the biosolids from MMSD’s two treatment facilities would be incinerated. The financial equation would be flipped. A revenue generator would morph into an expense. Customer rates would have to rise to fill the gap.

“It would change the whole ethic of MMSD,” Shafer said, referring to a scenario in which Milorganite is no longer commercially viable. “We’ve been doing this since 1926. It’s kind of built into us. To take that away or change that really changes the nature of the district.” How so? “Well, we’re not built on a sustainable model anymore,” he said.

Caught in the Middle

The U.S. Environmental Protection Agency, under pressure from all sides, has shied away from stringent regulation of pollutants in biosolids. The agency has identified 352 unregulated contaminants in biosolids, according to a 2018 report from the Office of the Inspector General, its internal watchdog. The agency sets limits on just nine contaminants, all heavy metals. (Pathogens are also regulated for Class A biosolids, like Milorganite.)

Public interest groups argue that the EPA’s approach is too timid. They fear the agency is allowing a chemical contamination problem to spread into the nation’s soil, water, and food supply.

The clamor has only grown stronger with PFAS, a class of thousands of chemicals that are defined by their persistence in the environment and their toxicity to human bodies. Last year, the agency set first-ever limits for six PFAS in drinking water, and it designated PFOA and PFOS as hazardous substances under the federal Superfund law. Yet the agency has not regulated these chemicals in biosolids, even as contamination hot spots have emerged.

Farmers in Michigan and Maine have had their farms shut down, dairy herds culled, and their milk supply destroyed due to contamination from PFAS connected to biosolids spread on or near their land. Last June, five Texas farmers, alleging damage to their businesses, sued the agency for its failure to regulate PFAS in biosolids.

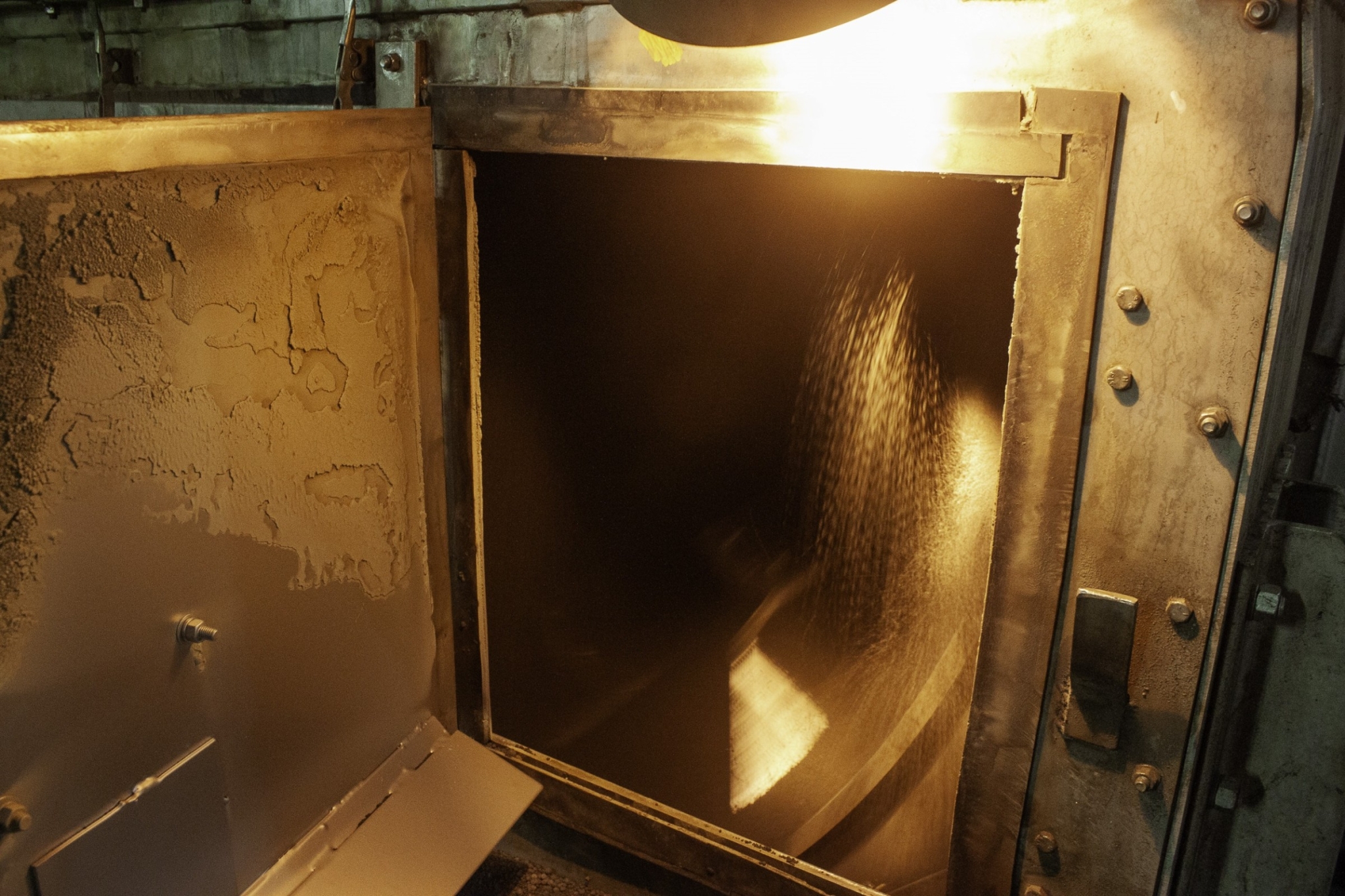

Dryers at Milwaukee’s Jones Island Water Reclamation Facility heat and tumble biosolids into Milorganite pellets. Photo © Brett Walton/Circle of Blue

Wastewater agencies bemoan being caught in the middle of this battle. Federal regulators have not indicated they will ban PFAS from commerce, which would eliminate the source of pollution. At the same time, sewage treatment byproducts have to go somewhere. Land application, mostly on farm fields, is the primary method because it is generally the cheapest. The EPA is the biosolids permitting authority for 41 states. According to its data, some 56 percent of biosolids were land applied nationally in 2022.

If regulators severely limit land application, the organizations that process America’s sewage say they would have to rely on landfills or incinerators that burn the waste. These options have social, financial, and environmental drawbacks too, said Kristina Surfus, of the National Association of Clean Water Agencies, an industry trade group.

And they have physical constraints. The primary landfill in Maine will be at capacity by 2028 after the state’s land application ban. Waste processors, for months after the ban, shipped biosolids to Canada because local landfills were not designed to handle them. Biosolids disposal costs for wastewater utilities doubled during this time. Altogether, responding to PFAS contamination in biosolids could remake how the country manages its sewage waste.

“So it’s really going to be a huge, huge problem nationally if we move away from land application entirely,” Surfus said.

First Mover

Corporate chemists had not yet developed PFAS when Milorganite was born. Its origin was nearly a century ago, when Jones Island, an industrial site south of downtown and adjacent to Lake Michigan, was expanded to make room for a pioneering solution to a growing city’s sewage problem.

Sediment dredged from the Milwaukee River was deposited lakeside to create new land to accommodate a complex of buildings that became the Jones Island Water Reclamation Facility, still the state’s largest sewage treatment facility.

Milorganite is a rare product. Surfus could point to only two other utilities nationwide – Tacoma Public Utilities and DC Water – that convert their biosolids into a commercial retail fertilizer. The Metropolitan Water Reclamation District of Greater Chicago uses a different process to extract nitrogen and phosphorus from wastewater at its Stickney Water Reclamation Plant. The nutrients crystalize into granules that are sold as a slow-release fertilizer branded as Crystal Green.

In Milwaukee, the transformation of sewage sludge to fertilizer occurs inside an arena-sized building with a matter-of-fact name: the Drying and Dewatering Facility. The aroma inside the building is distinct. Malty, yeasty, certainly organic, with a faintly sweet undernote. It’s not overwhelming, but not exactly pleasant, as if a candle maker developed an experimental flavor that was rejected as too funky.

Step by step, the nutrient-rich sludge is dried, heated, and tumbled to produce Milorganite pellets. Fourteen silos store the product on site until it is bagged and shipped to stores like Lowe’s and Home Depot.

In the absence of federal requirements for PFAS in biosolids, executive director Shafer referred to state regulations in Michigan and Minnesota as guideposts for MMSD. These states have multiple tiers of precautionary measures that become stricter as PFAS levels in biosolids increase. Both set thresholds above which PFAS-contaminated biosolids cannot be land applied. And both allow biosolids with less than 20 parts per billion of PFOA and PFOS to be spread on land without restriction. Maryland enacted similar guidelines.

MMSD, at the request of state regulators, began testing Milorganite for PFAS a year or two before the pandemic, Shafer said. PFAS levels in Milorganite are in the 7 ppb range.

The EPA’s limit for PFOA and PFOS in drinking water is more than a thousand times lower, regulated at 4 parts per trillion. The difference is because water is ingested.

Asked about possible shifts in public perception of the safety of Milorganite, Shafer said he did not know of any opinion polling. But he does see the steady annual sales figures.

“The only market research we have on Milorganite is that we can’t make enough of it,” Shafer said. “We can’t keep up with demand. Right now, it’s still trusted by people.”

Catch more news at Great Lakes Now:

Safe Drinking Water Act Turns 50

Amish Farmers’ Partnership With Beef Giant Produces Manure Mess

Featured image: Produced from Milwaukee’s biosolids, Milorganite is sold in retail home-and-garden centers nationwide as a turf grass fertilizer. Photo © Brett Walton/Circle of Blue